RESEARCH STUDY 26

The IMF and Gold

Revised edition, May 2001

(originally published as Research Study 20 in July 1998)

by

Dick Ware

"...From the written material that survives it seems as though the possibility of a

basket including gold was never explicitly considered. In a subsequent article,

however,16 the late Sir Joseph Gold gave it as his opinion that even the partial use

of gold would be precluded. As the principle architect of the text of the 2nd

Amendment, his obiter dicta obviously carry weight. But, as I have suggested,

times have moved on and there is no longer any need to anathematize gold,

especially if its partial use in this way might improve the economic lot of a small

number of countries which need all the stability they can get.

The law, perhaps, is too important to be left to lawyers..."

Source: https://www.gold.org/search/site/RS26Gold.pdf

Based on older post http://anotherfreegoldblog.blogspot.fi/2013/11/wgc-euro-dollar-and-gold.html

BIS, ESCB, ECB, FSB, G30, IAS2, IMF, IMS, OECD, OPEC, LBMA, WorldBank, UN ... Evolution of Monetary System in relation to Gold & Oil as asset classes...

Friday, December 18, 2015

Wednesday, December 16, 2015

Reforming the World Monetary System: Fritz Machlup and the Bellagio Group

Source: "Reforming the World Monetary System: Fritz Machlup and the Bellagio Group" By Carol M Connell

Friday, November 13, 2015

IMF - BoE - IMF LEGAL DEPARTMENT AND IMF INSTITUTE SEMINAR ON CURRENT DEVELOPMENTS IN MONETARY AND FINANCIAL LAW

May 7 – 17, 2002

Emergency Liquidity Financing by Central Banks:

Systemic Protection or Bank Bailout?

Ross S. Delston and Andrew Campbell

Source: https://www.imf.org/external/np/leg/sem/2002/cdmfl/eng/delst.pdf

Emergency Liquidity Financing by Central Banks:

Systemic Protection or Bank Bailout?

Ross S. Delston and Andrew Campbell

Source: https://www.imf.org/external/np/leg/sem/2002/cdmfl/eng/delst.pdf

Thursday, September 3, 2015

IMF - 1975 - Purchases under the Oil facility for 1975 - Prior use of Gold tranche

Gold tranche - Amount of gold that each member country of theInternational Monetary fund (IMF) contributes as part of itsmembership obligations to the fund, and can readily borrow when facing economic difficulties. See also special drawing rights.

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1975/SM/171899.PDF

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1975/SM/171899.PDF

CVCE - Plans and studies drawn up after the Werner Report

AEI - EMS - Texts concerning the European Monetary System

Texts concerning the European Monetary System

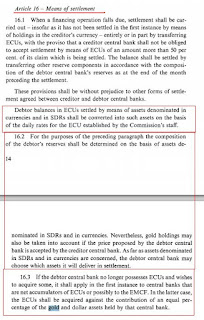

Agreement between the Central Banks of the Member States of . the European Economic Community laying down the operating procedures for the European Monetary System

Decision (No.12/79) of the Board of Governors of 13th March 1979

Agreement between the Central Banks of the Member States of . the European Economic Community laying down the operating procedures for the European Monetary System

13 March 1979

Council Regulation (EEC) No. 3180/78 of 18th December 1978 changing the value of the unit of account used by the European Monetary Co-operation Fund

Source: http://aei.pitt.edu/38739/1/A3700.pdf

CVCE - The difficulties of the monetary snake and the EMCF

"...the EMCF was established on 3 April 1973 30

and was the kernel of the future organisation of the central banks at

Community level. Its primary aim was to oversee the proper functioning

of the progressive narrowing of the fluctuation margins between the

Community currencies. It also had to monitor interventions in Community

currencies on the exchange markets. Finally, it was responsible for

settlements between central banks leading to a concerted policy on

reserves. The fund had legal personality and was administered by a board

comprising the governors of the national central banks 31

and one representative from the Commission (who was not a member of the

board in the strict sense: he had the right of address, but not the

right to vote). Generally, it had to abide by the agreements between the

central banks on the progressive narrowing of margins and short-term

support. 32

However, the fund did not have its own resources, and its powers were

limited because the principle of pooling reserves was not adopted. 33..."

Source: http://www.cvce.eu/en/collections/unit-content/-/unit/56d70f17-5054-49fc-bb9b-5d90735167d0/2d84f078-672e-4ae9-92d5-b4969911442a

Source: http://www.cvce.eu/en/collections/unit-content/-/unit/56d70f17-5054-49fc-bb9b-5d90735167d0/2d84f078-672e-4ae9-92d5-b4969911442a

ECB archive - 1978 - Outline of an agreement on the European Monetary System 12/12/1978

Source: https://www.ecb.europa.eu/ecb/history/archive/pdf/released/1978-12-12_Outline_agreement.pdf?6b22d1c608512cdaeb35027327f06b4a

---

MORE

Records released: https://www.ecb.europa.eu/ecb/history/archive/requested/html/index.en.html

Wednesday, September 2, 2015

ECB archive 1973 - EMCF - First directive of the Committee of Governors to the agent

British EUROPEAN MONETARY COOPERATION FUND

FIRST DIRECTIVE OF THE COMMITTEE OF GOVERNORS

TO THE AGENT,

DATED 14th INY 1973

FIRST DIRECTIVE OF THE COMMITTEE OF GOVERNORS

TO THE AGENT,

DATED 14th INY 1973

Source: https://www.ecb.europa.eu/ecb/history/archive/pdf/released/1st_directive_EMCF_agent_14_5_1973_EN.pdf?3d9bd073094cf6f76aeb6991b5074dc7

ECB archive - 1978 - Summary of questions and options - annex to the interim report on the European Monetary System - (Heyveart report no. 39)

BS - RM - The Bank of England’s revealing views on Gold in 1988

A repost of the original article created by Ronan Manly

at BullionStar:

Source: https://www.bullionstar.com/blogs/ronan-manly/the-bank-of-englands-revealing-views-on-gold-in-1988/

Extract:

Source: https://www.bullionstar.com/blogs/ronan-manly/the-bank-of-englands-revealing-views-on-gold-in-1988/

Extract:

"THE EXCHANGE EQUALISATION ACCOUNT’S HOLDINGS OF GOLD

- The EEA’s holdings of gold, including the gold swapped for ECU’s with the EMCF, amounts to 23.8 mn ozs, or some 740 tons. Since the substantial reduction in stocks in the late 1960’s and early 1970’s resulting from the then balance of payments’ crises, there has been no significant change in holdings. At the annual revaluation of the reserves in March 1988, the gold holdings were worth $8.1 bn. However as a share of total reserves they have fallen significantly from 31 per cent in 1980 to 17 per cent of total spot reserves now. Table 1 shows the change.

(c) Gold in the international monetary system

11. After the collapse of the Bretton

Woods system and the abolition of the fixed parities between domestic

currencies and gold, the international monetary community decided in

principle to remove gold from the international monetary system. Until

late 1978 central banks understood not to add to their gold stocks, and

the IMF and the USA reduced their gold holdings through auction.

12. However, the move to eliminate gold

never gathered much momentum, and has now petered out. The European

Monetary System (EMS) has given gold something of a new role in

international monetary affairs. Gold deposited with the EMCF can be used

to obtain currency through the ECU mobilisation process or (were we in

the exchange rate mechanism (ERM) through the use of official ECUs

themselves). However, EMS membership (or for that matter, ERM

participation) does not constitute an overwhelming ground for

maintaining present gold holdings, though ECU mobilisation, within

limits, makes gold deposited with the EMCF more liquid.

13. [The mechanism for creating ECUs

through the EMCF works on both gold and dollar deposits, so that to the

extent that gold was replaced by dollars, the EMCF’s capacity to create

ECUs would not be affected. Furthermore, the logic of the system is that

an identifiable Community asset is created against the deposit of

non-Community reserve assets, namely dollars and gold. There is no

reason in logic why EMCF members should not deposit 20 per cent of their

reserves in non-Community currencies other than dollars as well, eg.

Yen and Swiss Francs, if it is desirable to increase the scale of ECU

creation or to compensate for reductions in gold deposits.]

14. Looking forward over the longer term,

it is possible that if moves towards more managed rates continue, there

will be renewed attempts to restore gold to a more formal role as a

reserve asset. It was interesting to note the amount of speculation

along these lines in the US last Autumn, following Secretary Baker’s

proposal for a commodity indicator (including gold), even though

Secretary Baker was at pains to make it clear that he was not advocating

a commodity standard. However, the probability of this happening is not

sufficiently high to justify the UK retaining its gold stocks on these

grounds alone.

15. Gold is therefore left with something

more than a residual function. Its possession is likely to increase

confidence in the holder’s currency, at least in times of difficulty;

and although it is illiquid compared to many financial assets, and

expensive to store, in most circumstances it can be used as security for

borrowing or to obtain currency through swaps.

IMF adlib - 1964 - "International Reserve Units" Compared With Gold Tranche Positions in the Fund

Prepared by the Research & Statistics Department

March 16, 1964

Content:

1. "International Reserve Units"

...

2. Gold Tranche Positions in the Fund

...

3. Similarities Between Reserve Units and Gold Tranche Positions

...

4. Differences Between Reserve Units and Gold Tranche Positions

...

Extract:

"The Bernstein plan does not spell out how positions created proportional to quotas can be held proportional to gold holdings (unless quotas are proportional to gold holdings, which does not appear to be the intention). This point could be resolved by countries trading gold for units among themselves, or by some kind of transitional provisions."

Extracts from Mr. Bernstein's Paper on "A Practical Program for International Monetary Reserves"

Foreign Exchange as Reserve Units

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1964/DM/254005.PDF

Content:

1. "International Reserve Units"

...

2. Gold Tranche Positions in the Fund

...

3. Similarities Between Reserve Units and Gold Tranche Positions

...

4. Differences Between Reserve Units and Gold Tranche Positions

...

Extract:

"The Bernstein plan does not spell out how positions created proportional to quotas can be held proportional to gold holdings (unless quotas are proportional to gold holdings, which does not appear to be the intention). This point could be resolved by countries trading gold for units among themselves, or by some kind of transitional provisions."

Extracts from Mr. Bernstein's Paper on "A Practical Program for International Monetary Reserves"

Foreign Exchange as Reserve Units

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1964/DM/254005.PDF

IMF adlib - 1978 - Arrangements on Gold Among the Countries of the Group of Ten

January 19, 1976

Observation:

1. No price peg

2.Official G10 stock under ceiling

3. CB governed trading

4. Gold reporting to BIS and IMF

5.Validity 2y

Arrangements expired in January 31, 1978

Result is status quo on the IMS non-system.

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1978/EBS/236639.PDF

H/T to Ronan Manly

IMF adlib - Report on G-1O Gold Arrangements

Basle meeting on gold arrangements, January 1977, G10 governors and IMF Managing Director

Observation:

1. BIS is tracking movements of monetary gold

2. Establishment of ceiling

2. Gold for minting could be repurchased

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1977/EBS/231472.PDF

H/T to Ronan Manly

Monday, August 24, 2015

BdF - HH - The global financial cycle and how to tame it

International Symposium of the Banque de France “Central banking: the way forward?”

Paris, 7 November 2014

My second remark is related to the international monetary system. Since the end of the dollar’s link to gold, the de facto global anchor of the system is just the aggregate of the domestic monetary policies of the major reserve currencies. These policies may serve the domestic needs of each country or currency area. But this does not mean that they add up well for the world economy as a whole. The lack of a strong anchor is a key factor behind the excessive elasticity of the system. This means its inability to prevent the build-up of financial imbalances in the form of unsustainable credit and asset price booms.

The global policy interest rate needed for the entire world is very hard to achieve given the near-zero policy rate (negative in real terms) in the G7 countries (Graph 3). In particular, the IMF’s SDR interest rate in October was 3 basis points, with negative contributions from three-month eurepo and Japanese government bills.

The nominal global policy rate is currently around 2% (Graph 4). In a world growing in nominal terms by 5–6%, the global policy rate should surely exceed its current 2% level. The influence of the 3 basis-point SDR rate on this 2% global policy rate is one of the world economy’s great asymmetries.

I commend the IMF for trying to integrate the global dimension in its spillover reports. But the monetary policy recommendations for reserve currencies in its Article IV or World Economic Outlook reports tend to take a purely national perspective. Indeed, over the past 15 years in my recollection the IMF’s recommendations on monetary policy have almost always been in the direction of more easing. This suggests to me that the global perspective of the build-up of financial imbalances has been missing. All this means that the lack of global anchor of the international monetary system, well described by Tommaso Padoa-Schioppa, remains. And so does the system’s excessive elasticity and inability to constrain effectively global liquidity.

Source: https://www.banque-france.fr/fileadmin/user_upload/banque_de_france/La_Banque_de_France/Speech-Herve-Hannoun-symposium-141107.pdf

Paris, 7 November 2014

"...

Excessive elasticity of the international monetary system My second remark is related to the international monetary system. Since the end of the dollar’s link to gold, the de facto global anchor of the system is just the aggregate of the domestic monetary policies of the major reserve currencies. These policies may serve the domestic needs of each country or currency area. But this does not mean that they add up well for the world economy as a whole. The lack of a strong anchor is a key factor behind the excessive elasticity of the system. This means its inability to prevent the build-up of financial imbalances in the form of unsustainable credit and asset price booms.

The global policy interest rate needed for the entire world is very hard to achieve given the near-zero policy rate (negative in real terms) in the G7 countries (Graph 3). In particular, the IMF’s SDR interest rate in October was 3 basis points, with negative contributions from three-month eurepo and Japanese government bills.

The nominal global policy rate is currently around 2% (Graph 4). In a world growing in nominal terms by 5–6%, the global policy rate should surely exceed its current 2% level. The influence of the 3 basis-point SDR rate on this 2% global policy rate is one of the world economy’s great asymmetries.

I commend the IMF for trying to integrate the global dimension in its spillover reports. But the monetary policy recommendations for reserve currencies in its Article IV or World Economic Outlook reports tend to take a purely national perspective. Indeed, over the past 15 years in my recollection the IMF’s recommendations on monetary policy have almost always been in the direction of more easing. This suggests to me that the global perspective of the build-up of financial imbalances has been missing. All this means that the lack of global anchor of the international monetary system, well described by Tommaso Padoa-Schioppa, remains. And so does the system’s excessive elasticity and inability to constrain effectively global liquidity.

..."

Source: https://www.banque-france.fr/fileadmin/user_upload/banque_de_france/La_Banque_de_France/Speech-Herve-Hannoun-symposium-141107.pdf

Sunday, August 23, 2015

1973 - MOF VIEWS ON MONETARY REFORM

SUMMARY: FOLLOWING ARE VICE MINISTER INAMURA'S VIEWS ON MONETARY REFORM. THESE INDICATE DESIRE IS FOR ONLY SMALL MODIFICATION FROM PRESENT SYSTEM. EMPHASIS IS ON STABLE EXCHANGE RATES, TO BE CHANGED ONLY IN CASE OF FUNDAMENTAL DISEQUILIBRIUM. ELASTICITY FOR SYSTEM SHOULD CONTINUE TO BE THROUGH PROVISION OF CREDIT. AS CREDITOR COUNTRY JAPAN NOW IN FAVOR OF MANDATORY SETTLEMENT IN STRONG INTERNATIONAL ASSETS.

"...

6. IF THESE TECHNIQUES CAN BE EXPANDED SO THAT JAPAN CAN CONFIDENTLY GENERATE OUTFLOW OF YEN DENOMINATED LONG TERM CAPITAL TO FINANCE CURRENT ACCOUNT SURPLUS THEN PRESENT FL.."OAT SYSTEM MAY BECOME MORE ATTRACTIVE TO GOJ. THIS ESPECIALLY TRUE IN CONJUNCTION WITH FLEXIBLE USE OF CAPITAL CONTROLS WHEREBY FOREX SUPPLIES AND DEMAND CAN BE REGULATED UNILATERALLY TO INFLUENCE YEN/DOLLAR RATE. SUCH A SYSTEM, WHICH RESEMBLES PRESENT FLOAT, IF IT COULD BE CONTINUED, MIGHT OFFER JAPAN BETTER ALTERNATIVE THAN OPERATING UNDER REFORMED IMF RULES..."

Source: https://search.wikileaks.org/plusd/cables/1973TOKYO08319_b.html

"...

6. IF THESE TECHNIQUES CAN BE EXPANDED SO THAT JAPAN CAN CONFIDENTLY GENERATE OUTFLOW OF YEN DENOMINATED LONG TERM CAPITAL TO FINANCE CURRENT ACCOUNT SURPLUS THEN PRESENT FL.."OAT SYSTEM MAY BECOME MORE ATTRACTIVE TO GOJ. THIS ESPECIALLY TRUE IN CONJUNCTION WITH FLEXIBLE USE OF CAPITAL CONTROLS WHEREBY FOREX SUPPLIES AND DEMAND CAN BE REGULATED UNILATERALLY TO INFLUENCE YEN/DOLLAR RATE. SUCH A SYSTEM, WHICH RESEMBLES PRESENT FLOAT, IF IT COULD BE CONTINUED, MIGHT OFFER JAPAN BETTER ALTERNATIVE THAN OPERATING UNDER REFORMED IMF RULES..."

Source: https://search.wikileaks.org/plusd/cables/1973TOKYO08319_b.html

THE HISTORY OF U.S.RELATIONS WITH OPEC: LESSONS TO POLICYMAKERS

By JAREER ELASS and AMY MYERS JAFFE

SEPTEMBER 2010

"...Nixon and Kissinger believed that if Israel was victorious in the war, the Arab countries would realize that the best way to achieve their objectives would be through cooperation with the United States and its diplomatic efforts rather than by seeking military backing from the Soviet Union..."

"...However, Saudi Arabia was recognizing the need to put an end to the embargo, particularly after Shah Mohammed Reza Pahlavi of Iran proposed what some referred to as the “Christmas Eve massacre”—a more than doubling of the pric e of oil from $5.12 to $11.66 a barrel at a December 1973 meeting in Tehran. King Faisal wa s aware that such a gigantic price jump, coupled with a reduction of OP EC output, would prove disasterous to the West and undermine Washington’s ability to thwart communism. Three days later, Saudi Arabia led other Arab OPEC members in agreeing to increase their output, beginning the end of the embargo. However, Arab oil ministers only unconditionally lifted the embargo on March 18, 1974, after Kissinger had demonstrated movement on an Israeli-Egyptian resolution to the conflict, with the kingdom announcing a one million b/d boost in its oil production..."

"...In this post-embargo period, the United States began to work on diplomatic strategies to reduce the power of OPEC. As Henry Kissinger notes in his memoir, Years of Renewal, “For the power of OPEC to be broken, solidarity among the industrial democracies had to be established across a wide front, both political and economic.” Nixon called a Washington Energy Conference in February 1974 and that led to the establishment of the Energy Coordinating Group (ECG). As President Ford took office, this ECG was being institutionalized into the International Energy Agency (IEA), with a substantive program in “emergency sharing; energy conservation; active development of alternative energy sources; creation of a financial safety net.” The United States also appealed to key countries like Saudi Arabia to consider the benefits of consumer-producer cooperation. U.S. bilateral economic development commissions were created with Saudi Arabia and Iran, with an eye to encourage the use of oil surpluses for nation building and development projects. The U.S. aim was to “reduce the producers’ free funds for waging economic warfare or blackmail against the industrial democracies, and to return some of the extorted funds to our economy.” ..."

"... As student protests against the Shah Pahlavi began in Iran in early 1978, Iran and Saudi Arabia came together that following June to thwart efforts by price hawks within OPEC to fix the price of OPEC oil in a currency other than the U.S. dollar. At the very least, these hawkish producers were pushing to raise the price of OPEC oil to mitigate the declining purchase value of their oil revenues resulting from world inflation and the diminishing worth of the U.S. dollar, the currency in which OPEC was being paid for its oil...."

"By the summer of 1984, Saudi Arabia surprised its OPEC colleagues and the oil markets by exceeding its voluntary quota of 4.5 million b/d by one million b/d, causing oil prices to slide further. The Saudi move was ostensibly the result of the kingdom’s decision to exchange some 34 billion barrels of oil for 10 new Boeing 747 jetliners in a massive oil for goods barter arrangement—a deal brokered by the Reagan administration. Significantly, the Boeing planes oil barter deal involved a hidden discount for the Saudi oil at below official prices and as such destabilized the oil market even more.

By the summer of 1985, Saudi Arabia’s production had fallen to just 25 percent of its capacity, and the kingdom made the decision to start an oil price war to claw back its market share. The result was a price collapse, with oil hitting a low of $8.76/bbl (OPEC basket equivalent) in July 1986. It is unclear how much influence, if any at all, that the Reagan administration had on the Saudi decision to flood the markets with its oil in 1986. But the United States was certainly grateful for lower oil prices that perhaps, not coincidentally, also helped bankrupt and disable the Soviet Union, which was dependent upon oil for its hard currency.

The improvement in U.S.-Saudi relations and a unified worldview about the Soviet Union was accompanied by similarly friendly oil relations. Saudi Arabia sought oil refining and downstream investments in the United States and, in 1981, Saudi Oil Minister Hisham Nazer made an important policy pronouncement during a visit to Harvard University. Nazer called for a system of “reciprocal energy security” and implied that, in return for demonstration of security of demand on the part of the United States, America could gain guaranteed access to a “fairly priced ocean of oil...

...Oil markets were generally oversupplied and oil prices remained relatively low during the late 1980s, despite the continuation of the Iraq-Iran war through 1988. From 1987 to 1990, Kuwait and other GCC members of OPEC “helped keep oil prices down by exceeding OPEC-assigned production quotas.” The low prices not only helped the U.S. and global economy, adding to demand for GCC oil, but also were thought to hurt the pocketbooks of Iran and Iraq, thereby containing their potential military threat within the greater Gulf region. However, this reprieve ended quickly when Iraq invaded Kuwait on August 2, 1990. Within days, President George H.W. Bush had authorized the dispatch of American troops to Saudi Arabia as part of Operation Desert Shield. On August 6, the U.N. Security Council established strict economic sanctions on Iraq, effectively outlawing all Iraqi and Kuwaiti oil exports. Supplementing a request made in person by then-U.S. Defense Secretary Richard Cheney to allow U.S. troops in Saudi Arabia to ensure that Iraq did not continue to Saudi borders and to position the United States to repel the Iraqi invasion, the U.S. president sent a letter to King Fahd requesting that the kingdom increase its oil production to a maximum level to assure that the impact of the loss of Iraqi and Kuwaiti crude oil would be ameliorated. King Fahd granted the request, and Saudi Arabia began investigating how much oil was needed in the market—and how quickly it could expand its output potential to meet this demand..."

"...OPEC disarray in the early years of the Clinton White House took oil prices off the front burner in the United States again for several years. Ironically, the Clinton administration’s first tangle with OPEC came not from concerns that the cartel would restrict oil output and hurt the U.S. economy, but from fears that sharply falling oil prices might harm important U.S. allies such as Mexico. As oil prices fell to under $10/bbl in the wake of the Asian financial crisis of 1998, Energy Secretary Bill Richardson during a visit to Riyadh—which was ostensibly scheduled to discuss American oil firms participating in the potential upstream opening in Saudi Arabia that had been broached to U.S. oil firms by then-Crown Prince Abdullah in late 1998—reportedly raised the administration’s concerns about market oversupply and extreme price volatility with Saudi leadership. At a joint news conference with Richardson, Saudi Oil Minister Naimi said oil markets were oversupplied and that the kingdom promised to take steps to avoid harming the global economy. Former Saudi Oil Minister Yamani, speaking in Houston in the fall of 1999, told an audience that Richardson had “saved the oil industry” through his discussions with Naimi and the Saudi leadership, as the secretary had “persuaded” the kingdom into changing policy to help lift prices. The Saudis did not appear to require much of a push to want to restore prices, with the kingdom reportedly set on re-capturing a WTI price of $18-20/bbl as quickly as possible. .."

Source: http://bakerinstitute.org/media/files/Research/e3ef09d6/Amy_Jareer_U.S._Relations_with_cover_secured.pdf

Saturday, August 22, 2015

U.S. Foreign Economic Policy and Relations with Japan, 1969-1976

Thomas W. Zeiler

The University of Colorado

Working Paper No. 1

U.S.-Japan Project

Source: http://nsarchive.gwu.edu/japan/schaller.htm

U.S.-JAPAN PROJECT WORKING PAPER SERIES

Source: http://nsarchive.gwu.edu/japan/usjwp..htm

OIL - Euro Pricing of Crude Oil: An OPEC's Perspective

Euro Pricing of Crude Oil: An OPEC's Perspective

Samii, V. Massood

Thirunavukkarasu, Arul

Rajamanickam, Mohana

Southern New Hampshire University

Abstract: In the late 1970s and the early part of th e 1980s, a debate emerged within the Long Term Strategy Committee of the Organization of Petroleum Exporting Countries (OPEC) whether to continue the prici ng of crude oil in United States dollars or to shift to an alternative currency. This debate was rooted in the persistent decline in the value of the United States dollar relative to other global cu rrencies. The choice of currencies available to price crude oil was limited for OPEC because of the inadequate liquidity of most other currencies. With the recent emergence of th e euro, the issue of choice of currency for pricing crude oil has emerge d once again for policy discus sion. The current paper is focused on the implications of a shift in the pr icing of crude oil from United States dollar to euro on OPEC members. Winners and lose rs are identified based on economic gains and losses. It is concluded that while such a policy would incrementally benefit OPEC en bloc, it would result in a disadvantage for th e countries whose major trading partner is the United States and, therefore, would not be a Pareto optimal solution.

Source: http://www.luc.edu/orgs/meea/volume6/massood.pdfhttp://www.luc.edu/orgs/meea/volume6/massood.pdf

OIL - The cartel in retreat

1993 M. A. Adelman

Abstract:

Quotes:

In 1981, the price

of oil was $34 in current dollars ($50 at 1992 price levels). The

consensus was that it would keep rising toward the cost of synthetic

crude oil or some such long-run ceiling. In fact, the cartel had fixed

the price far above the point of maximum profit. OPEC members did not

lose their power, they regained their wits, and saw their limits. The

drop in consumption in belated response to the two price explosions was

borne entirely by OPEC as price guardian. Non-OPEC production rose. OPEC

market share fell to less than 30 percent. OPEC members kept a

remarkable cohesion. During 1982-1985 Saudi Arabia absorbed most of the

loss, and prices declined moderately. But when Saudi exports went to near-zero, they ceased to be the restrictor of last resort. The price

fell below $10, until OPEC could patch up a market sharing deal and

bring it back to the neighborhood of $18, where it has

remained.Consumption revived, and OPEC exports have approached but not

equaled the old peak. The once-massive excess capacity dwindled, but in

theory and in fact this had little effect on the price. Each increase in

exports meant a fresh contention over sharing it among members. OPEC

meetings and disputes became almost continuous. Each member did its best

to push the burden of restriction on to others. This limited OPEC

cohesion and power over price. The oil market became "commoditized,"

with many re-sellers probing for even a slight gain. Adherence to a

fixed price became much more difficult to monitor. Increasing reliance

had to be placed on production restraint. Low prices caused Iraq to be

hailed as savior for threatening Kuwait and Abu Dhabi, but this in turn

provoked invasion and war. Despite the shutdown of two major producers,

then one, prices have not revived. The cartel mission is to trade off

market share against a higher price.But their market share remains too

low to bear the losses a higher price would bring. Until it increases,

the cartel stays in a trap. Whether revenues were higher or lower, OPEC

members overspent them and ran current-account and budget deficits. They

had difficulty raising money for oil capital expenditures, which were

only a small fraction of total government expenditures. The Iraqi

aggression was an extreme example of this tension, and of thetemptation

of a rich neighbor. The world oil industry is an oddity. Socialism is

repudiated everywhere, yet most oil is produced by bumbling state

companies. The travail in the Former Soviet Union is the extreme example. Taxes on crude oil production in non-OPEC countries is usually

regressive and hinders development. But past mistakes are present

opportunities, and make likely continued long-time growth of non-OPEC

oil, with the OPEC price stuck in the market share trap.

Some samples:

Source: 35718454.pdf

Wednesday, March 4, 2015

BdI - R.Ossola

"E' MORTO RINALDO OSSOLA

ROMA L' ex ministro per il Commercio estero ed ex direttore generale della Banca d' Italia, Rinaldo Ossola è morto ieri a Roma. Ricopriva la carica di presidente del Credito Varesino ed era consigliere d' amministrazione delle Generali e della Danieli. Più volte ministro per il commercio estero nei governi Andreotti del 1976 e 1978, dopo aver lavorato per lunghi anni alla Banca d' Italia, di cui era diventato direttore generale nel 1975, Ossola era rientrato successivamente nel mondo bancario ricoprendo vari incarichi in Italia e all' estero..."

Source: http://ricerca.repubblica.it/repubblica/archivio/repubblica/1990/12/08/morto-rinaldo-ossola.html

1965 - Ossola group report: http://www.bis.org/publ/gten_b.pdf

ROMA L' ex ministro per il Commercio estero ed ex direttore generale della Banca d' Italia, Rinaldo Ossola è morto ieri a Roma. Ricopriva la carica di presidente del Credito Varesino ed era consigliere d' amministrazione delle Generali e della Danieli. Più volte ministro per il commercio estero nei governi Andreotti del 1976 e 1978, dopo aver lavorato per lunghi anni alla Banca d' Italia, di cui era diventato direttore generale nel 1975, Ossola era rientrato successivamente nel mondo bancario ricoprendo vari incarichi in Italia e all' estero..."

Source: http://ricerca.repubblica.it/repubblica/archivio/repubblica/1990/12/08/morto-rinaldo-ossola.html

1965 - Ossola group report: http://www.bis.org/publ/gten_b.pdf

Saturday, February 21, 2015

BUBA - Currency Blocs in the 21st Century

Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute

Working Paper No. 87

*Christoph Fischer Deutsche Bundesbank July 2011

Source: http://www.dallasfed.org/assets/documents/institute/wpapers/2011/0087.pdf

Working Paper No. 87

*Christoph Fischer Deutsche Bundesbank July 2011

Source: http://www.dallasfed.org/assets/documents/institute/wpapers/2011/0087.pdf

Wednesday, January 21, 2015

134. Memorandum From the President’s Assistant for National Security Affairs (Brzezinski) to the Cabinet

Washington, October 27, 1977.

- SUBJECT

- Energy Policy

Secretary Blumenthal has reported to the President that, in his conversations with Middle East leaders,2 it has become clear to him that the willingness of the oil exporting countries to cooperate with the U.S. in their oil pricing policies will depend to an important degree on their seeing evidence of our resolve to face up to this situation, specifically by putting in place adequate energy legislation.

The President asked me to report the above to you. He further asked that you make this point in your statements and speeches regarding our energy policy.

Zbigniew Brzezinski

Source: http://history.state.gov/historicaldocuments/frus1969-76v37/d134

122 Memorandum of Conversation

"...In a contingency basis: Offer preferential treatment for OPEC (Saudi) assets in return for (1) a Saudi commitment to progressively increase production levels, to continue to moderate price decisions within OPEC and to produce enough oil to prevent future tight market conditions, or (2) a Saudi commitment to enforce within OPEC an oil price agreement that provides for small price increases..."

Source: http://history.state.gov/historicaldocuments/frus1977-80v03/d122

Source: http://history.state.gov/historicaldocuments/frus1977-80v03/d122

Ford Knox old rumor

Source: http://news.google.com/newspapers?nid=861&dat=19800224&id=pSJIAAAAIBAJ&sjid=84AMAAAAIBAJ&pg=7098,5879716

H/T @KoosJansen

Monday, January 19, 2015

RM - Financial Crises and the International Monetary System

Robert MundellColumbia UniversityNew York, NY 100

27March 3, 2009

Source: http://www.normangirvan.info/wp-content/uploads/2009/03/mundell.pdf

27March 3, 2009

Source: http://www.normangirvan.info/wp-content/uploads/2009/03/mundell.pdf

PMG - The Collapse of the Bretton Woods Fixed Exchange Rate System

"The collapse of the Bretton Woods system of fixed exchange rates was one of the most accurately and generally predicted of major economic events.’ Hind- sight, of course, sharpens the perception of the inevitability of events and makes great prophets of those members of the spectrum of analysts who hap- pened to get their predictions right. But the general outlines at least of the key events from 1967 through 1971 were foreseen, starting from the work of Triffin (1960), whose warnings provided the compass to policymakers implementing serious changes in the provision of liquidity and the administration of capital controls in a vain attempt to preserve the system..."

Source: www.nber.org/chapters/c6876.pdf

Source: www.nber.org/chapters/c6876.pdf

Subscribe to:

Posts (Atom)