Gold tranche - Amount of gold that each member country of theInternational Monetary fund (IMF) contributes as part of itsmembership obligations to the fund, and can readily borrow when facing economic difficulties. See also special drawing rights.

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1975/SM/171899.PDF

BIS, ESCB, ECB, FSB, G30, IAS2, IMF, IMS, OECD, OPEC, LBMA, WorldBank, UN ... Evolution of Monetary System in relation to Gold & Oil as asset classes...

Thursday, September 3, 2015

AEI - EMS - Texts concerning the European Monetary System

Texts concerning the European Monetary System

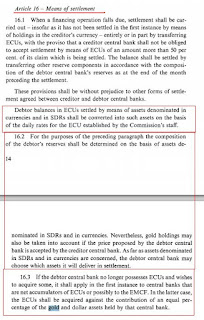

Agreement between the Central Banks of the Member States of . the European Economic Community laying down the operating procedures for the European Monetary System

Decision (No.12/79) of the Board of Governors of 13th March 1979

Agreement between the Central Banks of the Member States of . the European Economic Community laying down the operating procedures for the European Monetary System

13 March 1979

Council Regulation (EEC) No. 3180/78 of 18th December 1978 changing the value of the unit of account used by the European Monetary Co-operation Fund

Source: http://aei.pitt.edu/38739/1/A3700.pdf

CVCE - The difficulties of the monetary snake and the EMCF

"...the EMCF was established on 3 April 1973 30

and was the kernel of the future organisation of the central banks at

Community level. Its primary aim was to oversee the proper functioning

of the progressive narrowing of the fluctuation margins between the

Community currencies. It also had to monitor interventions in Community

currencies on the exchange markets. Finally, it was responsible for

settlements between central banks leading to a concerted policy on

reserves. The fund had legal personality and was administered by a board

comprising the governors of the national central banks 31

and one representative from the Commission (who was not a member of the

board in the strict sense: he had the right of address, but not the

right to vote). Generally, it had to abide by the agreements between the

central banks on the progressive narrowing of margins and short-term

support. 32

However, the fund did not have its own resources, and its powers were

limited because the principle of pooling reserves was not adopted. 33..."

Source: http://www.cvce.eu/en/collections/unit-content/-/unit/56d70f17-5054-49fc-bb9b-5d90735167d0/2d84f078-672e-4ae9-92d5-b4969911442a

Source: http://www.cvce.eu/en/collections/unit-content/-/unit/56d70f17-5054-49fc-bb9b-5d90735167d0/2d84f078-672e-4ae9-92d5-b4969911442a

ECB archive - 1978 - Outline of an agreement on the European Monetary System 12/12/1978

Wednesday, September 2, 2015

ECB archive 1973 - EMCF - First directive of the Committee of Governors to the agent

British EUROPEAN MONETARY COOPERATION FUND

FIRST DIRECTIVE OF THE COMMITTEE OF GOVERNORS

TO THE AGENT,

DATED 14th INY 1973

FIRST DIRECTIVE OF THE COMMITTEE OF GOVERNORS

TO THE AGENT,

DATED 14th INY 1973

Source: https://www.ecb.europa.eu/ecb/history/archive/pdf/released/1st_directive_EMCF_agent_14_5_1973_EN.pdf?3d9bd073094cf6f76aeb6991b5074dc7

BS - RM - The Bank of England’s revealing views on Gold in 1988

A repost of the original article created by Ronan Manly

at BullionStar:

Source: https://www.bullionstar.com/blogs/ronan-manly/the-bank-of-englands-revealing-views-on-gold-in-1988/

Extract:

Source: https://www.bullionstar.com/blogs/ronan-manly/the-bank-of-englands-revealing-views-on-gold-in-1988/

Extract:

"THE EXCHANGE EQUALISATION ACCOUNT’S HOLDINGS OF GOLD

- The EEA’s holdings of gold, including the gold swapped for ECU’s with the EMCF, amounts to 23.8 mn ozs, or some 740 tons. Since the substantial reduction in stocks in the late 1960’s and early 1970’s resulting from the then balance of payments’ crises, there has been no significant change in holdings. At the annual revaluation of the reserves in March 1988, the gold holdings were worth $8.1 bn. However as a share of total reserves they have fallen significantly from 31 per cent in 1980 to 17 per cent of total spot reserves now. Table 1 shows the change.

(c) Gold in the international monetary system

11. After the collapse of the Bretton

Woods system and the abolition of the fixed parities between domestic

currencies and gold, the international monetary community decided in

principle to remove gold from the international monetary system. Until

late 1978 central banks understood not to add to their gold stocks, and

the IMF and the USA reduced their gold holdings through auction.

12. However, the move to eliminate gold

never gathered much momentum, and has now petered out. The European

Monetary System (EMS) has given gold something of a new role in

international monetary affairs. Gold deposited with the EMCF can be used

to obtain currency through the ECU mobilisation process or (were we in

the exchange rate mechanism (ERM) through the use of official ECUs

themselves). However, EMS membership (or for that matter, ERM

participation) does not constitute an overwhelming ground for

maintaining present gold holdings, though ECU mobilisation, within

limits, makes gold deposited with the EMCF more liquid.

13. [The mechanism for creating ECUs

through the EMCF works on both gold and dollar deposits, so that to the

extent that gold was replaced by dollars, the EMCF’s capacity to create

ECUs would not be affected. Furthermore, the logic of the system is that

an identifiable Community asset is created against the deposit of

non-Community reserve assets, namely dollars and gold. There is no

reason in logic why EMCF members should not deposit 20 per cent of their

reserves in non-Community currencies other than dollars as well, eg.

Yen and Swiss Francs, if it is desirable to increase the scale of ECU

creation or to compensate for reductions in gold deposits.]

14. Looking forward over the longer term,

it is possible that if moves towards more managed rates continue, there

will be renewed attempts to restore gold to a more formal role as a

reserve asset. It was interesting to note the amount of speculation

along these lines in the US last Autumn, following Secretary Baker’s

proposal for a commodity indicator (including gold), even though

Secretary Baker was at pains to make it clear that he was not advocating

a commodity standard. However, the probability of this happening is not

sufficiently high to justify the UK retaining its gold stocks on these

grounds alone.

15. Gold is therefore left with something

more than a residual function. Its possession is likely to increase

confidence in the holder’s currency, at least in times of difficulty;

and although it is illiquid compared to many financial assets, and

expensive to store, in most circumstances it can be used as security for

borrowing or to obtain currency through swaps.

IMF adlib - 1964 - "International Reserve Units" Compared With Gold Tranche Positions in the Fund

Prepared by the Research & Statistics Department

March 16, 1964

Content:

1. "International Reserve Units"

...

2. Gold Tranche Positions in the Fund

...

3. Similarities Between Reserve Units and Gold Tranche Positions

...

4. Differences Between Reserve Units and Gold Tranche Positions

...

Extract:

"The Bernstein plan does not spell out how positions created proportional to quotas can be held proportional to gold holdings (unless quotas are proportional to gold holdings, which does not appear to be the intention). This point could be resolved by countries trading gold for units among themselves, or by some kind of transitional provisions."

Extracts from Mr. Bernstein's Paper on "A Practical Program for International Monetary Reserves"

Foreign Exchange as Reserve Units

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1964/DM/254005.PDF

Content:

1. "International Reserve Units"

...

2. Gold Tranche Positions in the Fund

...

3. Similarities Between Reserve Units and Gold Tranche Positions

...

4. Differences Between Reserve Units and Gold Tranche Positions

...

Extract:

"The Bernstein plan does not spell out how positions created proportional to quotas can be held proportional to gold holdings (unless quotas are proportional to gold holdings, which does not appear to be the intention). This point could be resolved by countries trading gold for units among themselves, or by some kind of transitional provisions."

Extracts from Mr. Bernstein's Paper on "A Practical Program for International Monetary Reserves"

Foreign Exchange as Reserve Units

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1964/DM/254005.PDF

IMF adlib - 1978 - Arrangements on Gold Among the Countries of the Group of Ten

January 19, 1976

Observation:

1. No price peg

2.Official G10 stock under ceiling

3. CB governed trading

4. Gold reporting to BIS and IMF

5.Validity 2y

Arrangements expired in January 31, 1978

Result is status quo on the IMS non-system.

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1978/EBS/236639.PDF

H/T to Ronan Manly

IMF adlib - Report on G-1O Gold Arrangements

Basle meeting on gold arrangements, January 1977, G10 governors and IMF Managing Director

Observation:

1. BIS is tracking movements of monetary gold

2. Establishment of ceiling

2. Gold for minting could be repurchased

Source: http://adlib.imf.org/digital_assets/wwwopac.ashx?command=getcontent&server=webdocs&value=EB/1977/EBS/231472.PDF

H/T to Ronan Manly

Subscribe to:

Posts (Atom)